Data-Driven Deal Sourcing Is “the New Black” for VCs

November 27, 2019 10 min. read

Try AI-Driven Insights

Monitoring for Free

Discover new business ideas and growth opportunities using

our AI-powered insights monitoring tool

Artificial intelligence methods allow you to process huge amounts of information, predict the near-term development of events and adapt the behavior to your forecast. These opportunities provide a huge advantage in areas such as investment management and trading.

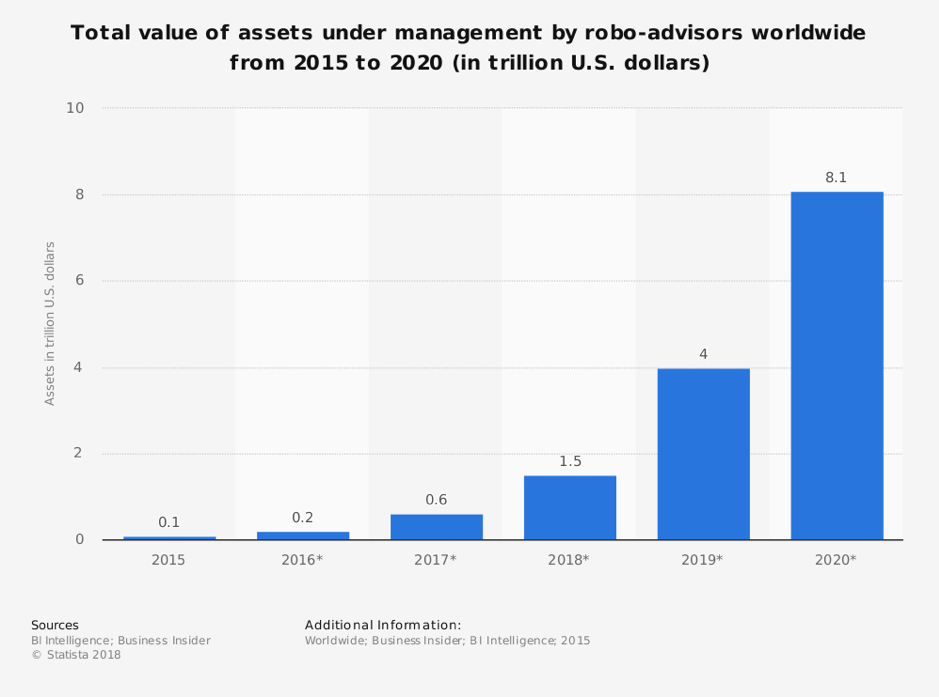

According to BI Intelligence forecasts, assets managed by automated advisors will grow from $0.6 trillion in 2017 to $8.1 trillion by 2020.

Artificial intelligence helps to cope with a number of problems in asset management – a huge amount of data that often can not be analyzed by a person, and the risk of following the emotions and making an irrational decision. Using AI algorithms is beneficial for both short-term and long-term investors.

AI to help you find the best startups

Hone Capital uses a machine learning model to study about 400 different characteristics and determine 20 common terms for initial deals in order to predict the future success of a startup. The machine defines the transition to the A-series round as the future success of companies.

Based on general characteristics, the model is ready to identify and recommend the best startups for investments, which increased the process of work to 20 deals per week.

According to the Thomson Reuters and Greenwich Associates report, half of the investment funds will rely more on artificial intelligence to make investment decisions over the next 5-10 years.

56% of investment funds plan to integrate artificial intelligence (AI) more into investment processes, and 40% expect an increase in the budget for AI. In addition, 70% of respondents either use alternative data or plan to do so in the coming year to expand the basic approach to investment.

The report demonstrates how investment research and processes have changed. Respondents identified three main aspects that determine the future of investment research: alternative data, artificial intelligence, and the changing relationship between investment funds and investment analysts.

To better understand the prospects for investment research in the next five to ten years from the point of view of asset managers, a survey of 30 investment directors, portfolio managers, and investment analysts from North America, Europe, and Asia was conducted. Below are the main findings of the study.

– As of 2018, only 17% of companies used AI in the investment process, such as machine learning and natural language processing, to analyze data, news, and content.

– The most popular sources of alternative data were aggregators, expert networks, and popular search queries.

– 50% of respondents were sure that when conducting research, investors will have less confidence in investment analysts.

How will artificial intelligence evaluate prospects?

Based on the work of the aforementioned Hone Capital, it can be assumed that the forecasting mechanism will look for a profitable startup for investments, analyzing what factors affect progress. The machine is able to assign success points for every factor that supposedly increases the startup’s chance of success.

Of course, artificial intelligence must be able to analyze a large number of previous successful and unsuccessful projects in order to find out what factors can be considered important for evaluating a startup. It is also important to find a causal relationship between ranking factors and the success/failure of companies.

As investment funds themselves do, the task of AI is to analyze the experience of the founders, the technical knowledge of the team, previous experience in launching companies, the ability to manage funds, and other similar success factors.

Mahesh Narayan, the international head of the portfolio and research management department in Thomson Reuters, believes that the market for investment research will change dramatically in the next 5-10 years. Investors will need to collect more data to support the new AI technologies and machine learning that are being invested in. In conducting research, portfolio managers will also rely less on investment analysts and more on internal research and suppliers to get the right tools and information.

According to Richard Johnson, traditional investment research is in danger of extinction, all thanks to the rapid emergence of new data and technologies. Laws aimed at downsizing research have made their value the most important aspect, which has radically changed the market for investment research. Financial information providers have the opportunity to assist asset management companies during this transition period. They can provide portfolio managers and investment analysts with data and tools that will allow them to rebuild business models and better control the progress of investment research. (Richard Johnson is vice president of market research and technology at Greenwich Associates.)

Some working examples?

Hong Kong Deep Knowledge Ventures specializes in investing in projects with fast exponential growth. The main resources and efforts of the company are focused on achieving the key goal – bringing to the market innovative developments in the field of personalized medicine (anti-aging, cancer prevention, diabetes, Parkinson’s disease, and Alzheimer’s).

The company uses software called VITAL (Validating Investment Tool for Advancing Life Sciences) to identify and evaluate investment opportunities. Analysts of the investment committee + artificial intelligence allow them to filter out unpromising projects. The fund is one of the few organizations that openly admits that it is trying to exclude people from its investment decisions.

Entrepreneur First, a London-based talent investor, created a search system for extremely talented people at the startup early stage. The company helps teams find a co-founder and provides them with the support they need to create new businesses.

Entrepreneur First uses proprietary algorithms to identify and pre-filter talents in its program based on characteristics such as work experience, education, and available contacts. The company’s team claims to have gathered the largest and most comprehensive database of how great founders look before they become successful project managers.

The American company Connetic Ventures is an investor for projects at an early stage and focuses on projects outside of Silicon Valley.

Connetic Ventures developed its own tool called Wendal, which helped automate the initial inspection process of projects. According to the fund, Vendal needs less than 10 minutes to find and analyze all the data necessary to make a decision on further due diligence or immediately investing.

An exciting fact: the decline in the bias of investment analysts in the selection process has allowed Connetic Ventures to achieve an astounding rate. The fund’s portfolio includes 42% of companies headed by women or minorities that would not be easy to find in the “human” venture world.

References:

More useful content on our social media: